Interior design

Yachting

Interior design

Yachting

Paris 3ème Marais

Paris 6ème Luxembourg

Paris 7ème Bac Saint-Germain

Paris 7ème Champ-de-Mars

Paris 8ème Saint-Honoré

Paris 9ème

Paris 15ème Saint-Charles

Paris 15ème Sèvres-Lecourbe

Paris 16ème Auteuil Passy

Paris 16ème Trocadéro

Boulogne Billancourt

Neuilly Sur Seine

Rent Rive Droite

Rent Rive Gauche

Cannes

Bruxelles South

Paris 3ème Marais

Paris 6ème Luxembourg

Paris 7ème Bac Saint-Germain

Paris 7ème Champ-de-Mars

Paris 8ème Saint-Honoré

Paris 9ème

Paris 15ème Saint-Charles

Paris 15ème Sèvres-Lecourbe

Paris 16ème Auteuil Passy

Paris 16ème Trocadéro

Boulogne Billancourt

Neuilly Sur Seine

Rent Rive Droite

Rent Rive Gauche

Cannes

Bruxelles South

Life insurance is one of the preferred investments for savers. Indeed, the contract makes it possible to meet the following objectives:

Subscription to a life insurance contract is accessible to everyone. Savers have every interest in subscribing to a life insurance contract as soon as possible in order to benefit from advantageous taxation.

1- Economic advantages:

2- Tax benefits:

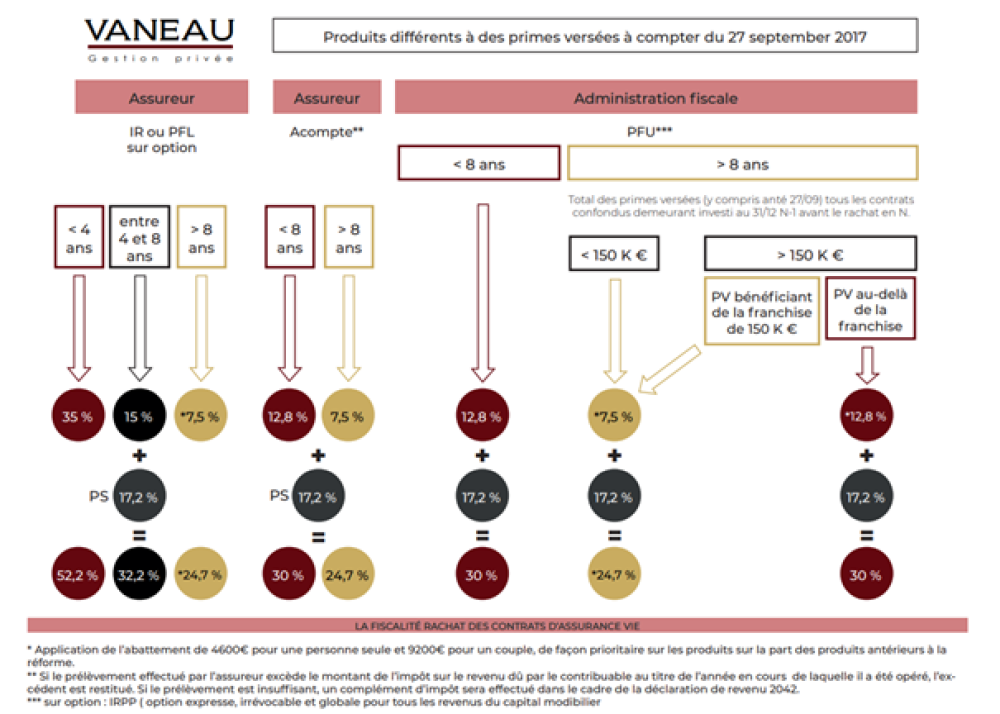

The financial products of life insurance contracts are taxed either at the progressive scale of income tax or at the rate of the levy in discharge. Whatever the method of taxation chosen, after 8 years an annual allowance of €4,600 for a single person or €9,200 for a married couple applies to the base subject to taxation (excluding social security contributions).

3- Succession advantage

Indeed, life insurance provides benefits at the inheritance level and also offers great freedom in investment choices (depending on your risk profiles of course).

At the level of succession, Art. 990 of the CGI (General Tax Code) specifies that for payments made before the age of 70, you obtain an exemption of €152,500 per beneficiary (all contracts combined). Beyond this allowance, the levy amounts to 20% for the fraction of the taxable part of each beneficiary less than or equal to €700,000, and to 31.25% for the fraction of the taxable part of each beneficiary exceeding this limit.

Art.757B of the CGI specifies that for payments made after age 70, the premiums paid are subject to inheritance tax after a deduction of 30,500 euros for all beneficiaries, capital gains realized are exempt from inheritance tax. succession.

Dismemberment of the beneficiary clause

The dismemberment of the beneficiary clause is another tax optimization technique based on the use of the life insurance contract.

The purpose of this designation is to organize the transfer of capital over time between several successive beneficiaries, while arranging the rights and obligations of each and allowing them to benefit from advantageous taxation.

The drafting of the clause must be the subject of all attention in order to avoid possible conflicting situations.

You have understood all the advantages of a life insurance contract, do not hesitate to contact us to obtain all the additional information you may need. We are at your disposal to advise you and support you in your heritage projects.

Would you like more information on our offers and services or carry out an asset assessment?Vous souhaitez plus de renseignements sur nos offres et services ou effectuer un bilan patrimonial ?

Our Vaneau Gestion Privée team is at your disposal to answer all your questions by email at service-client@vaneaugp.fr or by phone +33 1 45 03 80 95.

To contact us about your real estate project, please click on the bell.